Introduction

Have you ever dreamed of earning money while you sleep? It sounds too good to be true, right? That’s exactly what passive income offers. In just 12 months, I went from earning a traditional paycheck to generating a six-figure passive income stream. In this article, I’m going to break down exactly how I did it and how you can too. If you’re tired of the 9-5 grind and ready to take control of your financial future, keep reading!

What is Passive Income?

You might be wondering, what exactly is passive income? At its core, passive income is money earned with little to no ongoing effort. Unlike active income—where you trade time for money—passive income keeps flowing in even when you’re not working. Think of it as planting a tree that bears fruit for years to come.

The Mindset Shift

Before diving into passive income, you have to let go of the 9-5 mindset. We’ve been conditioned to believe that making money requires hard work, day in and day out. The truth is, it’s possible to earn without actively working every hour. But it requires a shift in thinking—towards long-term goals and investments that will pay off down the road.

Identifying the Right Passive Income Stream

There are countless ways to generate passive income, but not all are suitable for everyone. Some people earn through real estate, others through digital products, affiliate marketing, or stock investments. To find what works for you, research thoroughly and evaluate your skills, interests, and risk tolerance. Personally, I chose a mix of digital products and affiliate marketing, which matched my expertise in content creation.

My 12-Month Strategy

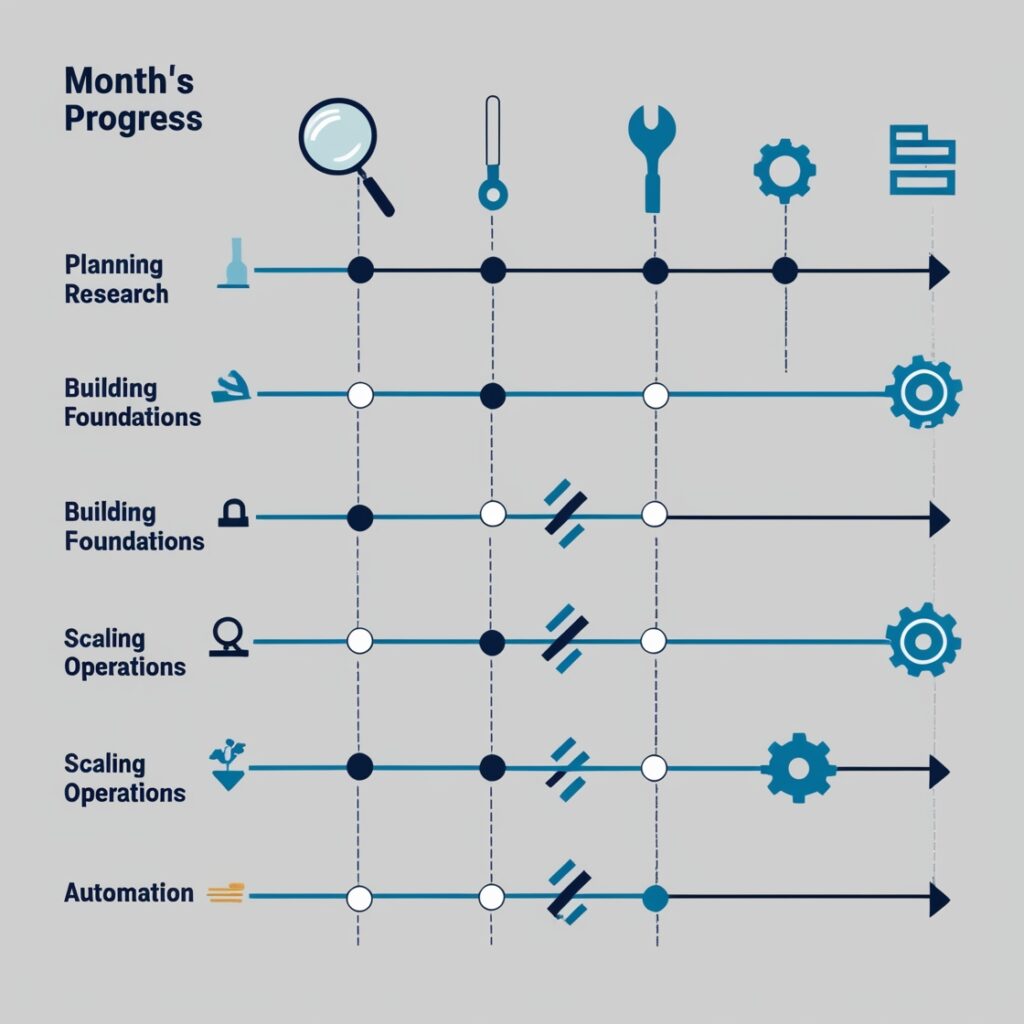

Here’s how I broke down my journey to six figures over the course of a year:

Month 1-2: Planning and Research

The first step was planning. I studied various passive income streams and settled on the ones that best suited my strengths. I also budgeted how much I was willing to invest and developed a realistic timeline. Proper research upfront saved me from costly mistakes later.

Month 3-6: Building the Foundation

Next, I started building the necessary infrastructure for my income streams. This involved creating digital products (like eBooks and courses), setting up a website, and signing up for affiliate programs. It was during these months that I invested the most time, laying the foundation for future earnings.

Month 7-9: Scaling Operations

Once my income streams were live, the focus shifted to scaling. I began promoting my products and content to reach a larger audience. I also started outsourcing tasks like marketing and content creation to free up my time for higher-level strategy.

Month 10-12: Automation and Maximizing Profits

By the final quarter of the year, I automated as much as possible. Using tools like email marketing automation and social media schedulers, I ensured that my income streams could run on autopilot. Meanwhile, I monitored and adjusted strategies to maximize profits, optimizing what was working and cutting what wasn’t.

Challenges I Faced

It wasn’t all smooth sailing. I faced setbacks like slow initial sales and marketing hurdles. I also made a few mistakes, such as focusing too much on one income source and neglecting diversification early on. But with each challenge, I learned and adjusted my approach.

Key Tools and Resources

A few tools made all the difference in my journey. I relied on platforms like Kajabi for selling digital products, Mailchimp for email marketing, and Tailwind for scheduling social media posts. I also consumed a lot of knowledge from books, podcasts, and courses on passive income strategies, which helped me stay informed and motivated.

The Importance of Consistency

Success doesn’t happen overnight, and the key is consistency. I tracked my progress weekly, refined my strategies, and kept pushing forward even when results were slow. This persistence is what ultimately led to my six-figure income.

Celebrating Small Wins

It’s important to celebrate the little milestones along the way. Whether it was making my first $100 or hitting 1,000 subscribers on my blog, these small wins kept me motivated and focused on the bigger picture.

How I Reinvested My Earnings

Once the money started rolling in, I didn’t stop. I reinvested a portion of my earnings back into my business by upgrading tools, outsourcing more tasks, and diversifying into other income streams like real estate and stock market investments. This allowed me to grow even further.

Conclusion

Building a six-figure passive income stream in 12 months wasn’t easy, but it was entirely possible with the right mindset, strategy, and consistency. The road to financial freedom doesn’t happen overnight, but with dedication, it’s achievable. Start small, stay focused, and don’t give up.

FAQs

1. What is passive income?

Passive income refers to earnings derived from a source that requires minimal effort to maintain, such as rental properties, dividend stocks, or digital products.

2. How much money do I need to start?

It depends on the type of passive income stream. Some methods require little to no upfront cost (like affiliate marketing), while others (like real estate) require more capital.

3. How can I avoid common mistakes?

Research thoroughly before investing time or money, and don’t put all your eggs in one basket. Diversification is key to minimizing risk.

4. Is passive income really “hands-off”?

No. While it’s called passive income, it still requires initial setup and occasional monitoring. However, the effort is much lower than active income once the system is in place.

5. What’s the fastest way to grow passive income?

Focus on scaling and automation. Once you find a successful stream, invest in tools or outsourcing to grow without adding more to your workload.