Developing a millionaire mindset is about more than just money; it’s about creating a mental foundation that allows you to pursue and attain wealth. This mindset shapes how you view finances, take risks, and stay disciplined in the face of setbacks. A true millionaire mindset doesn’t just seek to achieve wealth but also to sustain it over time, using strategies and principles that promote long-term growth. In this guide, we’ll dive into the essential mental shifts that successful individuals adopt on their journey to wealth and explore how you can apply these shifts to transform your own financial future.

Understanding the Millionaire Mindset

What is the Millionaire Mindset?

The millionaire mindset is a way of thinking that prioritizes growth, resilience, and the pursuit of opportunity. It’s about maintaining an optimistic view of your financial future and believing that your potential for wealth is unlimited. Individuals with this mindset are open to learning, persistent in their goals, and willing to take calculated risks to reach financial success. The millionaire mindset is not just about accumulating wealth; it’s about constantly seeking self-improvement and remaining adaptable in a rapidly changing financial landscape.

Why the Right Mindset Matters in Wealth Creation

Without the right mindset, financial success becomes a difficult, even impossible task. Your mindset influences your decision-making, your resilience in times of difficulty, and your ability to capitalize on opportunities. A millionaire mindset equips you with the confidence to overcome challenges, the courage to pursue unconventional paths, and the discipline to stick to your goals. It’s this foundation that separates those who succeed from those who settle.

Shift #1: Embrace Abundance over Scarcity

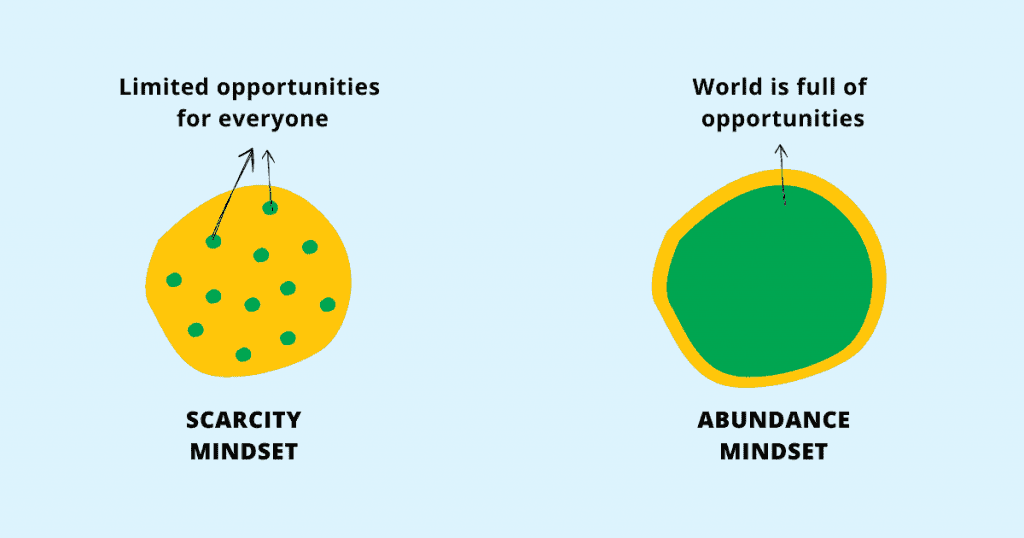

Scarcity vs. Abundance Mindset

A scarcity mindset focuses on limitations, whether it’s money, time, or resources. This mindset sees wealth as a finite resource, leading to fear and a tendency to avoid risk. In contrast, an abundance mindset believes there is enough for everyone, encouraging openness to new opportunities and trust in the process of growth. Millionaires often see the world as full of possibilities, enabling them to pursue ambitious goals without fearing the lack of resources.

How to Cultivate an Abundance Mindset Daily

To embrace abundance, start by practicing gratitude each day. This could involve listing things you appreciate in your life, helping shift your focus from lack to gratitude. Surround yourself with people who have positive attitudes toward growth and wealth. Begin setting and pursuing goals that stretch your boundaries, proving to yourself that limitations are often self-imposed and that possibilities are abundant.

Shift #2: Set Clear Financial Goals

The Power of Purpose in Financial Planning

Setting clear financial goals is a cornerstone of the millionaire mindset. Without direction, your efforts can feel scattered and unproductive. Financial goals give you a roadmap, breaking down your journey into manageable steps and allowing you to measure your progress. A strong purpose behind your goals gives you the motivation to persevere, especially when obstacles arise.

SMART Goals for Financial Success

To create effective financial goals, apply the SMART framework—Specific, Measurable, Achievable, Relevant, and Time-bound. Rather than setting a vague goal like “become wealthy,” set a goal to “save $10,000 in one year by setting aside a specific amount each month.” SMART goals make it easier to track progress and make adjustments, helping you stay motivated.

Shift #3: Prioritize Financial Education

Learning as a Lifelong Process

Financial education is essential to making sound investment and spending decisions. Millionaires recognize that financial literacy is a lifelong journey, and they are constantly learning about new trends, technologies, and strategies. From understanding compound interest to mastering tax strategies, financial education empowers you to make decisions that will grow and protect your wealth.

Essential Financial Topics to Master

A millionaire mindset includes knowledge in areas like budgeting, investing, and wealth management. Learn about diversification to protect your investments, tax-saving strategies to maximize returns, and budgeting techniques to keep your finances in check. The more knowledgeable you are, the less likely you are to make costly mistakes.

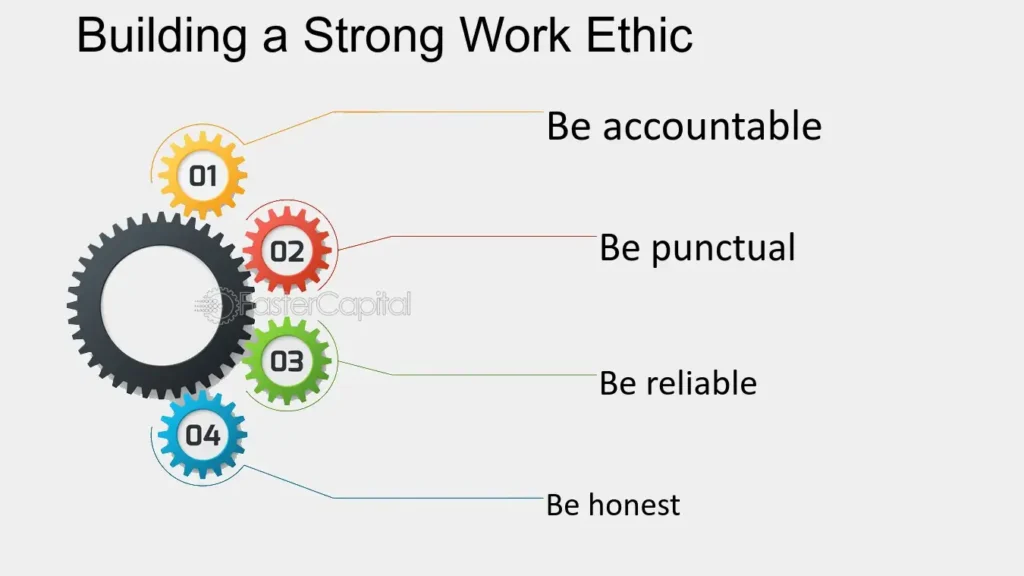

Shift #4: Develop a Strong Work Ethic and Commitment

Why Hard Work and Persistence Matter

While passive income and smart investments are key to wealth-building, they are often built on a foundation of hard work. Millionaires understand the importance of putting in effort, especially in the early stages. Hard work combined with persistence allows you to develop the skills, network, and capital needed to pursue higher-level wealth-building strategies.

Strategies for Building Consistency and Dedication

To stay consistent, set daily or weekly routines that keep you on track with your financial goals. For instance, set aside time each week to review your investments, plan your expenses, or research new opportunities. Celebrate small milestones to keep your motivation high, and always remind yourself why you started.

Shift #5: Take Calculated Risks

Understanding Risk and Reward

Every investment or financial decision carries some level of risk, but it’s essential to understand the difference between reckless and calculated risks. Millionaires are known for their willingness to take risks, but they don’t do so blindly. They assess potential returns against the risks and only proceed if the potential benefits align with their goals.

Strategies for Managing Financial Risk Wisely

To manage risk, diversify your investments to avoid putting all your capital into a single venture. Educate yourself thoroughly before taking big financial steps, and consider the worst-case scenarios. Building a financial cushion for unexpected losses also helps you take risks without compromising your financial stability.

Shift #6: Build Multiple Streams of Income

Importance of Diversification in Wealth Creation

Having multiple income streams not only increases your earnings but also safeguards you against potential financial setbacks. Millionaires typically diversify their income sources, creating resilience in times of economic uncertainty.

Popular Income Streams for Aspiring Millionaires

Some common additional income streams include real estate investments, dividend-paying stocks, and side businesses. Rental properties can provide passive income, while investments in the stock market offer potential for both growth and income. Freelance or consulting work based on your skills can also be a valuable supplement to your main income source.

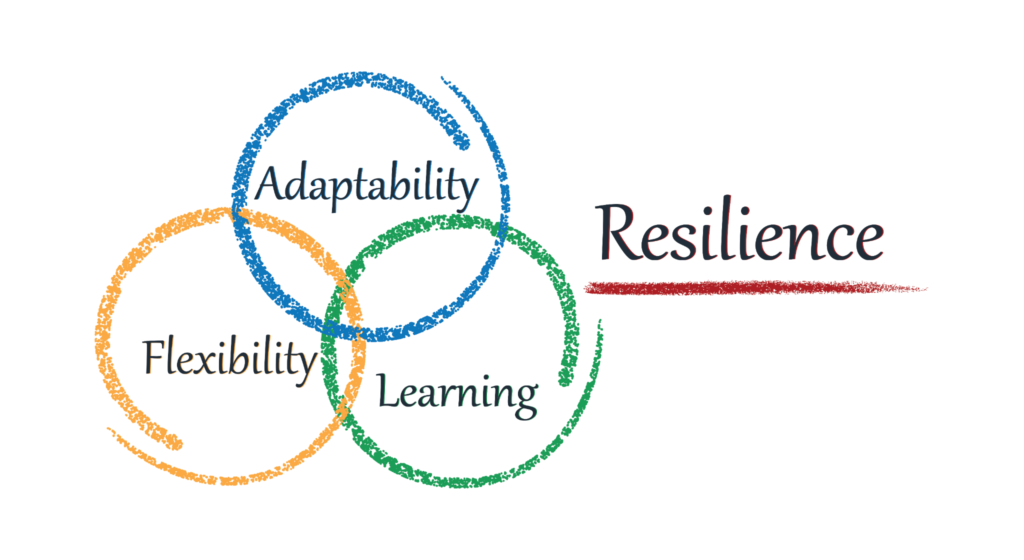

Shift #7: Cultivate Resilience and Adaptability

Why Resilience is Key to Financial Success

In any wealth-building journey, there will be setbacks. Those with a millionaire mindset view setbacks as learning experiences rather than failures. Resilience allows you to bounce back from losses, adapt to changing financial landscapes, and stay focused on long-term goals.

Building Resilience for Financial Setbacks

To build resilience, develop a mindset that embraces change and uncertainty. Accept that failure is part of growth, and make adjustments based on what you learn from each setback. Consider setbacks as temporary and continue working toward your goals, no matter the challenges.

Common Mistakes to Avoid on the Path to Wealth

Fear of Failure

Fear can prevent you from taking risks, exploring new opportunities, or even setting high goals. By focusing on potential growth rather than potential failure, you can move forward confidently.

Overlooking Financial Health

Neglecting basic financial management can quickly derail your wealth-building journey. Always prioritize budgeting, track your spending, and manage debt to maintain financial health.

The Long-Term Vision: Thinking Beyond Quick Gains

Why Patience Pays Off in Wealth Creation

Patience is essential for wealth creation. The process requires time and consistency, and those with a millionaire mindset understand that rushing for quick profits often leads to poor decisions and burnout.

The Benefits of Compounding Over Time

Patience allows you to benefit from compounding, where the interest on your investments earns additional interest. This effect is particularly powerful over long periods, making consistent contributions to investments incredibly impactful.

Conclusion

Achieving a millionaire mindset is about shifting your beliefs, habits, and approach to money. Each of these seven shifts can create a lasting impact on your financial journey, but remember that progress is gradual. Start applying these shifts in small ways, and over time, you’ll find yourself on the path to greater financial security and, ultimately, wealth.

FAQs

- What is the millionaire mindset?

- The millionaire mindset is a belief system focused on growth, resilience, and opportunity, shaping how individuals approach wealth-building and financial success.

- How long does it take to develop a millionaire mindset?

- Developing this mindset is a gradual process, requiring consistent effort and openness to new habits, usually over several years.

- What role does discipline play in wealth creation?

- Discipline is key in managing finances, sticking to goals, and resisting impulses, which supports long-term wealth.

- Can anyone achieve financial success with these principles?

- Yes, with the right mindset, discipline, and perseverance, anyone can work toward financial success, regardless of their starting point.

- Is risk-taking necessary to become wealthy?

- Calculated risk-taking is essential, as it often opens opportunities for growth, though it’s important to balance risk with stability.

You might also like:

Master Your Mindset: 10 Proven Mindset Shifts to Unlock Your Full Potential

7 Deadly Money Mistakes That Are Holding You Back from Wealth

10 Simple Fitness Tips That Will Transform Your Body in 30 Days

10 Must-Have Wardrobe Essentials Every Man Needs in 2024