In just 30 days, you can take meaningful steps to turn around your financial situation. The journey from “broke” to “financially empowered” doesn’t mean you’ll be an overnight millionaire, but it does mean you’ll establish the habits, mindset, and actions to put yourself on a path to financial freedom. Think of this as a financial boot camp. Each day, each step, and each decision you make will bring you closer to a more stable financial future. Let’s dive into this 30-day plan to transform your finances, guiding you from where you are now to where you want to be.

Understanding Your Current Financial Position

Before you can set sail toward financial success, you need to know where your starting point is. Many people avoid this step, thinking it will only make them feel worse about their situation, but understanding your baseline is empowering. This includes knowing what you own, what you owe, and what you spend.

A good starting point is calculating your net worth. This doesn’t have to be an overwhelming process—it’s simply a matter of listing out all your assets (like your savings, any property, or investments) and subtracting your liabilities (debts, loans, and any outstanding bills). This number might surprise you. For some, it’s a wake-up call. For others, it’s a starting point for improvement. Either way, your net worth is a clear picture of where you stand financially. Alongside this, tracking your monthly income and expenses down to the smallest purchase helps you identify where your money goes. You might even uncover some spending patterns that you hadn’t noticed before, like a daily coffee habit or frequent online shopping sprees. Once you know where you are, you can start mapping out where you want to go.

Setting Goals That Matter: The Power of 30-Day Financial Objectives

Setting financial goals is an art. The reason so many people don’t achieve their financial aspirations is not a lack of desire, but rather a lack of clarity and structure. This is where SMART goals come in—setting goals that are Specific, Measurable, Achievable, Relevant, and Time-bound can change your life. For the next 30 days, think of goals that are not just about numbers but also about behavior. Maybe it’s saving $200 this month, paying off a small debt, or eliminating unnecessary spending.

Each goal serves a purpose beyond itself. Saving $200 isn’t just about having more cash—it’s about showing yourself that you have the discipline to save and proving that your financial goals are within reach. Paying off a small debt isn’t just about reducing what you owe; it’s about clearing the mental burden that debt carries. When you set goals with specific targets and clear reasons, it becomes easier to make sacrifices and stay motivated. Every dollar saved and every unnecessary expense avoided brings you closer to these goals.

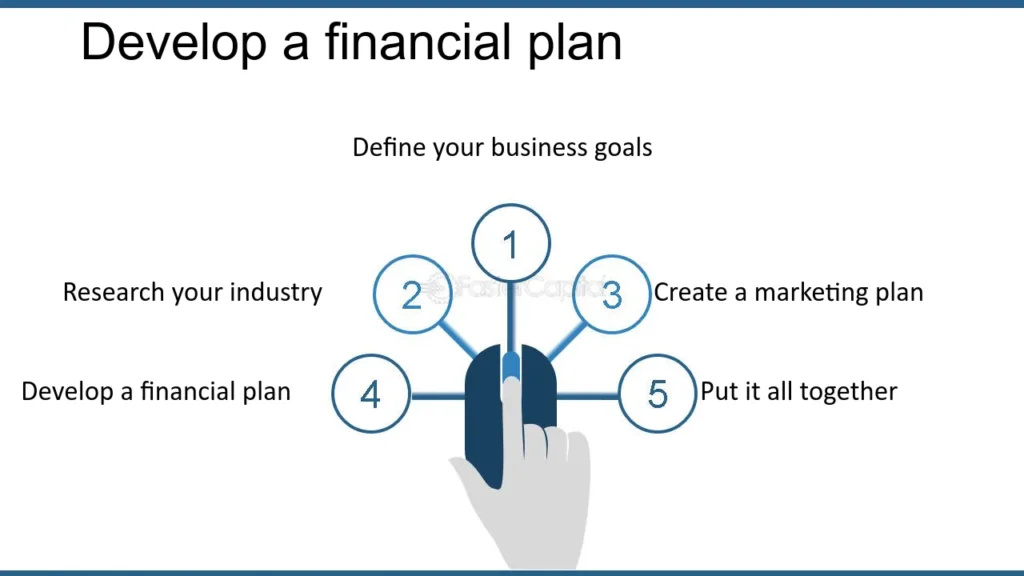

Developing a Step-by-Step 30-Day Financial Plan

With your goals set, the next step is creating a concrete 30-day plan that will guide you day by day. The beauty of a 30-day challenge is that it’s short enough to stay focused but long enough to make a meaningful impact. Start with a weekly breakdown of tasks, allowing you to build momentum.

In Week 1, focus on awareness. Track every dollar you spend, identifying areas where you can cut back. In Week 2, begin putting money aside, even if it’s just a small amount at first. For Week 3, explore ways to increase your income, whether through a side hustle, freelance work, or selling unused items. Finally, in Week 4, review your progress and reflect on any adjustments you need to make moving forward. Each week builds upon the last, creating a solid foundation that you can carry with you beyond these 30 days.

Mastering the Basics of Budgeting

Budgeting isn’t just about restricting yourself—it’s about giving yourself freedom within limits. A budget tells you exactly where your money is going and lets you make intentional choices about your spending. Start by listing out all your income and then categorize your expenses. A useful trick is to divide expenses into “fixed” and “variable” categories. Fixed expenses include rent, loan payments, and utilities, while variable expenses might be groceries, entertainment, and dining out.

Once you’ve outlined these, you can allocate a daily, weekly, or monthly allowance to each category. For example, setting a daily budget for incidentals, like snacks or coffee, keeps you mindful of those small, often overlooked expenses that can add up. With a monthly overview, you get a big-picture look at your financial health, making it easier to stay on track. Budgeting isn’t about deprivation—it’s about making your money work for you in the most effective way possible.

Cutting Down on Non-Essential Expenses: Finding Hidden Savings

One of the quickest ways to improve your finances is by cutting down on non-essential expenses. This doesn’t mean giving up all the small joys in life, but rather prioritizing what matters most. Start by reviewing your expenses and identifying areas where you can trim down. Common culprits include eating out, subscription services, and unnecessary shopping. Could you cook at home a few more times a week? Could you downgrade or pause some of those streaming services for a month?

Another tip is comparison shopping. For essentials like groceries, household items, or even insurance, spend a bit of time finding the best deals. Opting for generic brands, buying in bulk, or using discount codes can result in substantial savings over time. By making a few small changes, you might find that you’re able to free up a significant amount of money each month that can then be directed toward your financial goals.

The Importance of an Emergency Fund

Financial emergencies are inevitable. Whether it’s a medical bill, car repair, or unexpected household expense, having a dedicated fund can be a lifesaver. Start small—aim to set aside even $5 to $10 a day. Over time, this fund will grow and become a financial buffer, giving you peace of mind and protecting you from going further into debt during tough times.

If possible, automate this process by setting up a separate account or using a bank feature that transfers a small amount into savings with each purchase. This way, saving for emergencies becomes a habit, not a chore. An emergency fund isn’t just a nice-to-have—it’s a necessity for maintaining financial stability.

Increasing Your Income with a Side Hustle

Finding ways to earn extra money can accelerate your financial progress, and it doesn’t always require a major time commitment. Look for side hustles or freelance work that fit your skills and interests. Platforms like Upwork and Fiverr make it easy to find gigs in fields ranging from writing and design to customer service and consulting. Alternatively, if you have a hobby you’re passionate about—like photography, crafting, or baking—consider monetizing it by selling your creations or services online.

Side hustles aren’t just about the money—they’re a chance to expand your skills, network, and maybe even find a passion you didn’t know you had. Every extra dollar earned is a step closer to financial freedom.

The Basics of Smart Investing

Investing is one of the most effective ways to build wealth over time, but it can feel intimidating at first. Start small with beginner-friendly options like high-yield savings accounts or index funds. These investments allow you to grow your money steadily without requiring in-depth knowledge of the stock market.

Remember, investing is about long-term growth, not quick wins. Even setting aside a small portion of your savings each month can make a big difference over time. By starting now, you’re taking the first step in building a financial future that works for you, rather than relying solely on saving.

Managing and Paying Off Debt

Debt can feel overwhelming, but by approaching it strategically, you can take control of it. Start by listing all your debts, from credit cards to student loans, and prioritize paying off the ones with the highest interest rates first. High-interest debt, like credit card debt, grows quickly, so eliminating it should be a top priority. If you’re managing multiple debts, consider debt consolidation, which combines several smaller debts into a single loan with a lower interest rate. This approach simplifies your payments and can make the debt feel more manageable.

Managing debt requires persistence, but each payment brings you closer to financial freedom. And remember, paying off debt isn’t just about reducing what you owe—it’s about freeing up money for future goals and investments.

Building Financial Habits That Last

Long-term financial success isn’t about big actions—it’s about the small, consistent habits you build along the way. Start by tracking your daily expenses, even the small purchases you’d normally overlook. Seeing these purchases in black and white helps you stay aware and prevents mindless spending.

Impulse control is another powerful habit. When you’re tempted by an unplanned purchase, try waiting 24 hours before making a decision. Often, the desire fades, saving you from unnecessary expenses. These small actions, when practiced regularly, build a foundation of discipline that makes larger financial goals achievable.

Improving Your Credit Score

A good credit score opens doors, from lower interest rates to better financing options. To boost your score, focus on paying bills on time and using credit responsibly. Try to keep your credit utilization (the amount you owe compared to your credit limit) below 30%, and check your credit report regularly for errors.

Improving your credit score may take time, but each positive step you take strengthens your financial standing. It’s a powerful asset that can make future financial moves easier and more affordable.

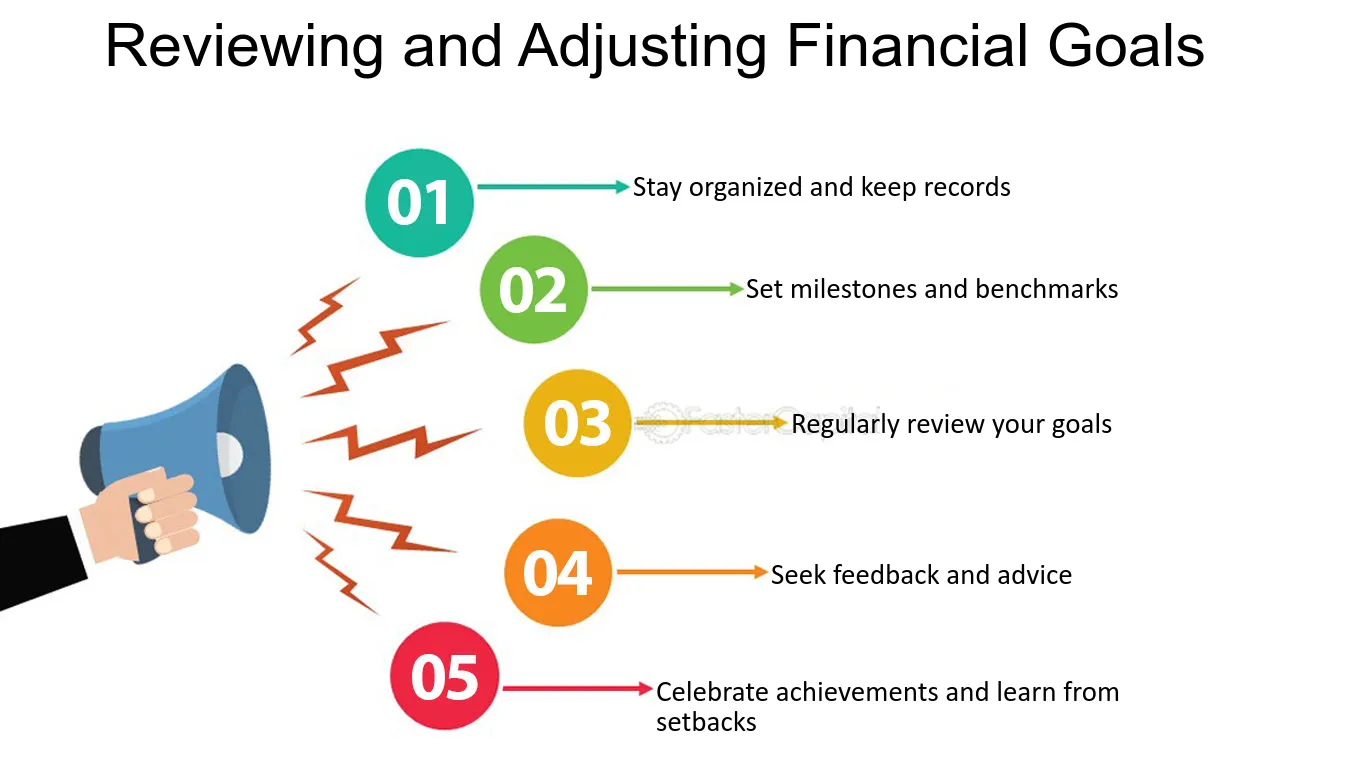

Reflecting on Your Financial Progress and Planning Ahead

At the end of 30 days, take time to reflect on your journey. What changes made the biggest impact? What habits do you want to keep? Celebrate the progress you’ve made, no matter how small, and use it as a stepping stone for the next phase of your financial journey.

This reflection is essential. It reminds you of what’s possible and gives you a sense of accomplishment that will fuel your motivation moving forward. By taking these steps over the last month, you’ve laid a strong foundation for a secure, financially independent future.

Conclusion

Transforming your finances in 30 days is challenging, but entirely possible. Each step, from budgeting to saving, reducing debt to investing, moves you closer to a place of stability and freedom. You’re not just changing your bank balance; you’re changing your mindset, habits, and future. Whether you’re starting from a tough place or just looking to improve, this plan is a roadmap to financial transformation. It’s a journey worth taking—because a secure financial future is one of the greatest gifts you can give yourself.

FAQs

1. Can I really change my finances in just 30 days?

Absolutely! While you won’t become rich overnight, 30 days is enough time to make meaningful changes to your spending habits, start a budget, and lay the groundwork for a healthier financial future. Small but consistent actions can lead to big improvements over time.

2. What if my income is too low to save or invest?

Even on a low income, small amounts set aside each week can add up. Focus first on reducing expenses and building an emergency fund. If possible, consider starting a side hustle or finding ways to increase income. Every dollar saved and invested counts toward your financial future.

3. How can I stay motivated to manage my money better?

Set small, achievable goals and celebrate each win. Remind yourself of your larger financial goals, such as financial freedom or paying off debt. Keeping a daily or weekly check-in on your finances can also help keep you on track and motivated.

4. Is it safe to start investing if I’m still new to personal finance?

Yes, as long as you start small and focus on low-risk options like high-yield savings accounts or index funds. Avoid putting all your money in high-risk investments and educate yourself on basics first. Investing gradually is a powerful tool for building wealth over time.

5. What’s the best way to get out of debt quickly?

List all your debts and prioritize paying off high-interest debts first. Consider using the “debt snowball” or “debt avalanche” method to stay organized. Paying more than the minimum on each debt, if possible, will help reduce the overall time and interest paid.

You might also like:

Investing 101: How to Make Your Money Work for You

10 Proven Money-Making Strategies You Can Start Today!

5 Must-Have Accessories for Men

How to Build Unshakable Confidence: 5 Secrets from Experts

Step-by-Step Gym Routine for Beginners: Achieve Maximum Gains