So, you’re interested in investing in stocks? Great choice! Investing is a proven way to grow your wealth and help secure a more comfortable future. But the stock market can seem like a confusing world full of terms, data, and decisions. No worries—by the end of this guide, you’ll have a clearer understanding and be ready to start building your own path to wealth through stocks.

Why Invest in Stocks?

When people think about wealth building, stocks are often one of the first ideas that come to mind. Why? Because stocks can offer a powerful combination of growth and income over time. By investing in stocks, you can benefit from a company’s success, earning returns through price increases and dividends.

Benefits of Stock Investing

- Wealth Building: Stocks can provide significant returns, especially if you invest in a well-performing company.

- Diversification: Stocks let you own pieces of different companies, industries, and markets.

- Liquidity: Unlike real estate, you can sell stocks relatively quickly when you need cash.

Long-Term Wealth Building

Investing in stocks isn’t a “get rich quick” scheme. It’s about building wealth steadily over time. By holding stocks for the long term, you can benefit from compounding returns and ride out short-term market volatility.

Basic Terms Every Investor Should Know

Before diving in, let’s go over some essential terms you’ll encounter in stock investing.

- Stock: A share of ownership in a company.

- Bond: A loan you give to a company or government with a promise of repayment with interest.

- ETF (Exchange-Traded Fund): A basket of stocks or assets you can buy as a single unit.

- Dividends: Regular payments some companies make to shareholders from their profits.

- Capital Gains: Profit earned when you sell a stock at a higher price than you paid.

Types of Stocks

Different stocks serve different purposes, and knowing the difference can help you choose the best ones for your goals.

Common Stocks vs. Preferred Stocks

- Common Stocks: Most people invest in common stocks. They offer potential growth and voting rights in the company.

- Preferred Stocks: These pay fixed dividends and are less volatile but usually lack voting rights.

Growth Stocks vs. Value Stocks

- Growth Stocks: These stocks are from companies expected to grow faster than the overall market. They usually reinvest profits rather than paying dividends.

- Value Stocks: Often underpriced, these stocks are seen as bargains and can offer good returns when the market recognizes their value.

Getting Started with Stock Investing

To succeed in the stock market, start with a clear vision of your goals. Why are you investing? Do you want to build a retirement fund, buy a house, or simply grow your wealth?

Setting Financial Goals

Define short-term and long-term goals. Knowing what you want to achieve can help shape your investment strategy and keep you motivated.

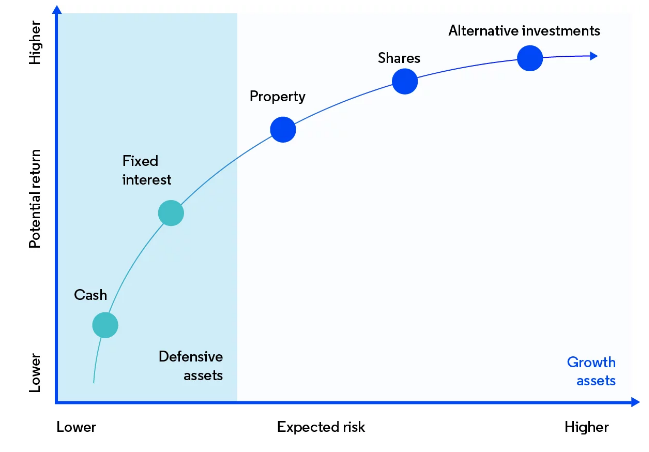

Assessing Risk Tolerance

Everyone has a different comfort level with risk. Some people can handle the ups and downs of the stock market, while others prefer safer investments. Understanding your risk tolerance will help guide your decisions.

Choosing a Brokerage Account

To buy stocks, you’ll need a brokerage account. This is where you’ll hold your investments and make transactions.

Types of Brokerage Accounts

- Traditional Brokerage Accounts: Offer full trading capabilities but may have fees.

- Robo-Advisors: Use algorithms to manage your investments based on your goals and risk tolerance.

- Self-Directed Accounts: For those who want full control over their investments.

Comparing Platforms and Fees

When choosing a brokerage, consider the fees, trading tools, and customer service. Some platforms charge commissions, while others offer free trades but may have hidden costs.

How to Research Stocks

Investing in a company without research is like driving blind. To make informed decisions, you need to understand a stock’s fundamentals and market trends.

Fundamental Analysis

This involves analyzing a company’s financial health, including revenue, profit margins, and growth potential. Look at metrics like the price-to-earnings (P/E) ratio and earnings per share (EPS) to gauge value.

Technical Analysis

Technical analysis focuses on stock price patterns and trends. It involves reading charts and using indicators like moving averages to predict future movements.

Understanding Stock Market Indices

Indices track the performance of groups of stocks and provide a snapshot of the market’s overall health.

Major Indices (S&P 500, NASDAQ, Dow Jones)

Each index has unique characteristics:

- S&P 500: Includes 500 large U.S. companies, offering a broad market view.

- NASDAQ: Known for tech stocks, like Apple and Microsoft.

- Dow Jones: Tracks 30 blue-chip companies and is one of the oldest indices.

Why Indices Matter

Indices help you compare individual stock performance against the market and assess economic trends. They also offer investment options through index funds, which mirror the index’s performance.

Creating a Diversified Portfolio

A diversified portfolio spreads your investment across different assets, reducing the risk of a single investment hurting your returns.

Importance of Diversification

Diversification helps manage risk by spreading out your investments. When one asset performs poorly, another might perform well, balancing your portfolio.

Different Ways to Diversify

You can diversify by:

- Industry: Invest in companies across various sectors.

- Geography: Look for opportunities globally.

- Asset Type: Combine stocks with bonds, ETFs, and real estate.

Setting an Investment Budget

Budgeting your investment funds is crucial. Decide how much you can allocate each month without impacting your daily expenses.

Allocating a Monthly Investment Budget

Start small if you’re new to investing. Even $50 a month can grow over time. Once you’re comfortable, you can gradually increase your investment budget.

Avoiding Common Budgeting Mistakes

Don’t over-invest in a single stock or put all your funds in the stock market. Set aside some cash for emergencies, and make sure you have a diverse portfolio.

Buying Your First Stock

Ready to make your first purchase? Here’s how to get started.

Steps to Purchase

- Open your brokerage account.

- Search for the stock symbol.

- Choose the number of shares and the order type (market or limit).

- Place the order.

Understanding Market Orders vs. Limit Orders

- Market Order: Buys or sells at the current market price.

- Limit Order: Sets a specific price; only executes if the stock reaches that price.

Monitoring Your Investments

Once you’ve invested, keep an eye on your portfolio. But remember, frequent monitoring isn’t necessary if you’re investing for the long term.

How Often to Check Your Portfolio

A monthly or quarterly check-in is usually enough. Too much monitoring can lead to impulsive decisions, especially if the market fluctuates.

Adjusting Investments Based on Goals

As your financial goals change, adjust your portfolio. You may want to add more conservative investments as you near retirement, for example.

Managing Risks in Stock Investment

Every investment has risks, but you can manage them by making informed choices and having patience.

Importance of Patience in Investing

Stocks can be volatile. Staying invested for the long term allows you to benefit from market rebounds after downturns.

Knowing When to Sell

Knowing when to sell can be tricky. A good rule of thumb is to sell if your investment goals or financial needs change, or if the stock’s fundamentals weaken.

Investing for the Long Term

Building wealth takes time. Long-term investors often benefit from compounding growth, where returns build upon returns.

Benefits of Long-Term Holding

Stocks have historically provided solid returns over time, and long-term holding helps you benefit from this growth.

Compounding Growth Over Time

With compounding, your initial investment and its returns generate additional earnings. This growth can be substantial over many years, helping you achieve your financial goals.

Conclusion

Stock investing can seem overwhelming at first, but with the right approach, it’s one of the best ways to build wealth over time. By starting with clear goals, understanding your risk tolerance, and staying patient, you can make the most of your investment journey. Remember, every successful investor was once a beginner!

FAQs

- What’s the best time to invest in stocks?

Anytime! Start when you’re ready, and focus on long-term growth rather than timing the market. - How much money should I start with?

Even a small amount, like $50, is a good start. Invest what you’re comfortable with. - Can I lose all my money in stocks?

It’s possible, but unlikely with a diversified portfolio and informed decisions. - Is investing in stocks the same as gambling?

Not at all! Stock investing relies on research and long-term growth, unlike gambling’s unpredictability. - How do dividends work in stock investing?

Dividends are regular payments from profitable companies. They’re a great way to earn income while holding stocks.

You might also like:

7 Deadly Money Mistakes That Are Holding You Back from Wealth

10 Proven Money-Making Strategies You Can Start Today!

The Secret to Staying Fit: 10 Habits of Highly Successful Athletes

Mindset Reset: SIX Techniques to Reprogram Your Brain for Success

10 Must-Have Wardrobe Essentials Every Man Needs in 2024

H