Investing might sound intimidating, especially if you’re just starting. But once you get a grasp of the basics, it becomes an empowering way to take control of your financial future. This guide walks you through the essentials of investing, helping you turn your hard-earned cash into potential wealth for the future.

What is Investing, and Why is it Important?

Investing is simply the act of putting your money into assets like stocks, bonds, or real estate with the expectation of earning a return. Unlike saving, which focuses on preserving money for short-term goals, investing is all about growth over the long term.

Investing helps you reach financial goals faster by making your money work for you, and it’s one of the few ways to build wealth beyond simply working more hours.

Benefits of Investing

1. Growing Your Wealth Over Time

The primary benefit of investing is that it allows your money to grow over time. Through strategies like compound interest and asset appreciation, your investments can multiply, giving you far more than if you’d just kept the money in a savings account.

2. Protection Against Inflation

Inflation reduces the purchasing power of money over time. Investing can help you stay ahead of inflation by potentially providing returns that outpace rising prices.

Understanding Different Types of Investments

Investing isn’t one-size-fits-all. There are numerous types of assets, each with unique risks, returns, and benefits. Here’s a look at some common ones:

Stocks

When you buy stocks, you own a piece of a company. Stocks can offer high returns but are typically more volatile.

Bonds

Bonds are loans made to companies or governments. They’re generally safer than stocks, but they offer lower returns.

Real Estate

Real estate can provide steady cash flow and long-term appreciation, making it a popular choice for many investors.

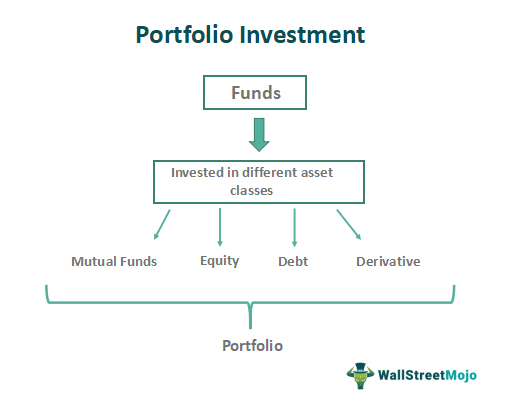

Mutual Funds and ETFs

Mutual funds and ETFs pool money from multiple investors to buy a diversified portfolio of stocks or bonds. They offer an easy way to diversify.

Cryptocurrencies and Alternative Investments

Crypto and other alternative investments are high-risk but offer high potential returns. These are suitable for investors comfortable with volatility.

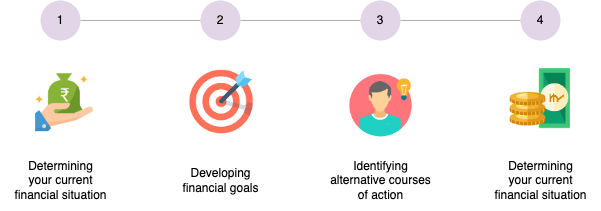

Setting Financial Goals for Investment

Before you invest, it’s crucial to define your financial goals. Your goals will determine the type of investments suitable for you:

Short-Term vs. Long-Term Goals

Short-term goals, like buying a car, need safer investments with lower volatility. Long-term goals, like retirement, can handle more risk since they have time to recover from market dips.

Risk Tolerance and Financial Objectives

Your risk tolerance—the amount of volatility you’re comfortable with—helps guide your investment choices. Being clear on your objectives helps you stay committed to your investment plan.

Understanding the Risk-Return Relationship

Investments with higher potential returns typically come with greater risks. Understanding this relationship helps you make informed choices:

High-Risk vs. Low-Risk Investments

Stocks and cryptocurrencies are high-risk, high-reward options. Bonds and savings accounts are low-risk but offer modest returns.

Balancing Risk with Reward

The key is to find a balance that fits your financial goals and comfort level. High-risk investments may suit aggressive growth goals, while safer options are ideal for preserving wealth.

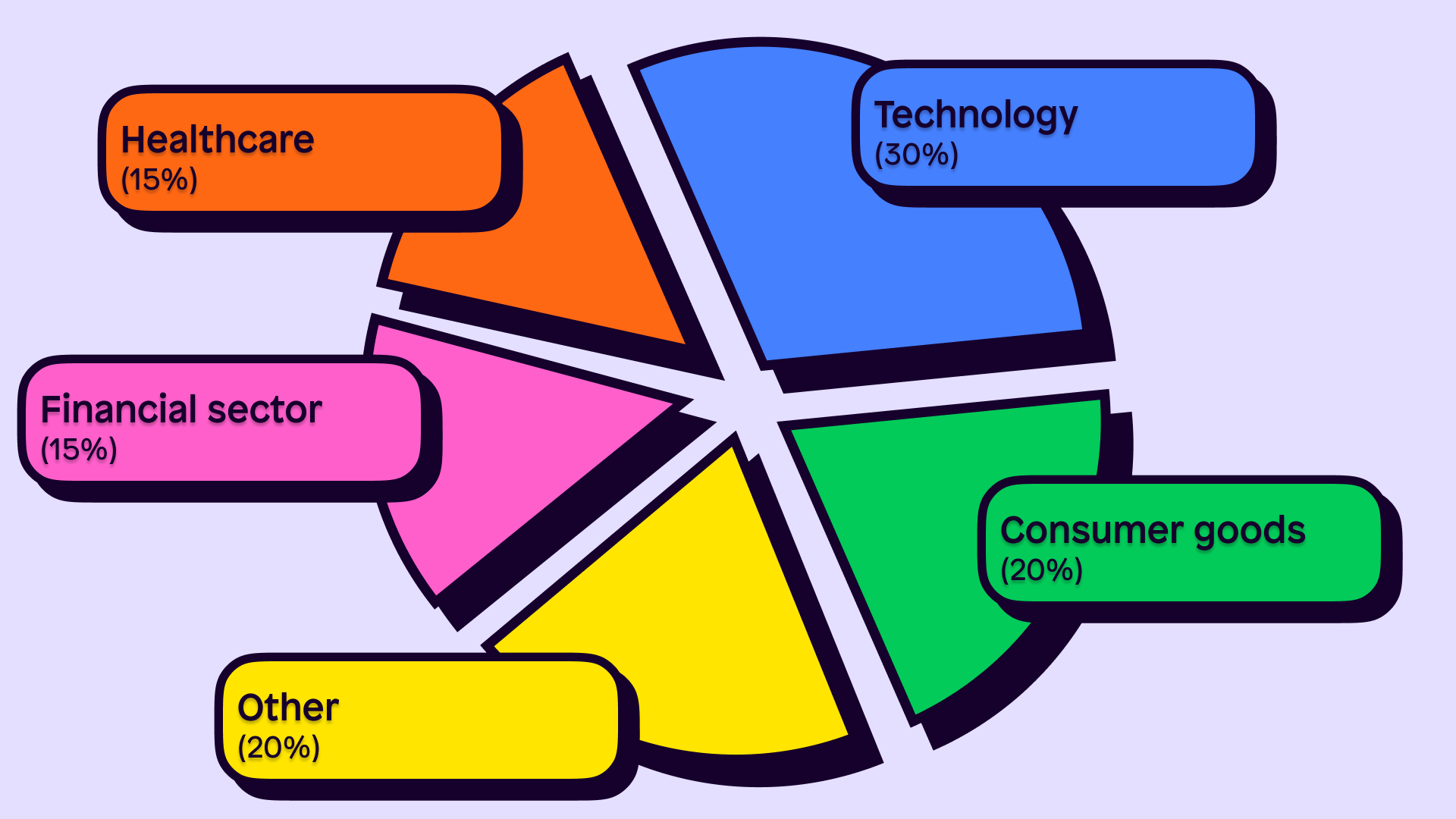

The Importance of Diversification

Diversification is a key strategy to manage risk. It involves spreading investments across various assets to reduce the impact of a single asset’s poor performance.

How Diversification Helps Reduce Risk

By holding a mix of stocks, bonds, and other assets, you avoid putting all your eggs in one basket. This way, if one investment performs poorly, others may offset the loss.

Building an Investment Portfolio

Building a portfolio means creating a mix of assets that match your goals. A diversified portfolio may include a mix of stocks, bonds, and real estate.

Allocating Assets Based on Goals

If you’re young and investing for retirement, you might want a higher percentage of stocks. Those closer to retirement may prioritize bonds for safety.

Rebalancing Your Portfolio Over Time

Rebalancing ensures your asset mix stays aligned with your goals and risk tolerance, adjusting for growth or market changes.

Investment Strategies for Beginners

There are a few beginner-friendly strategies that can help you get started:

Dollar-Cost Averaging

This involves investing a fixed amount regularly, regardless of market conditions. It reduces the impact of market volatility.

Buy-and-Hold Strategy

Buying and holding investments over a long period helps smooth out short-term fluctuations and benefits from overall market growth.

Growth vs. Income Investing

Growth investing focuses on assets that may appreciate, while income investing aims for steady payouts, like dividends.

Understanding the Power of Compound Interest

Compound interest is the secret sauce of investing. It’s interest on interest, allowing your money to grow faster over time.

Examples of Compounding in Different Investments

Stocks with reinvested dividends and tax-free retirement accounts benefit greatly from compounding, multiplying your initial investment several times over the years.

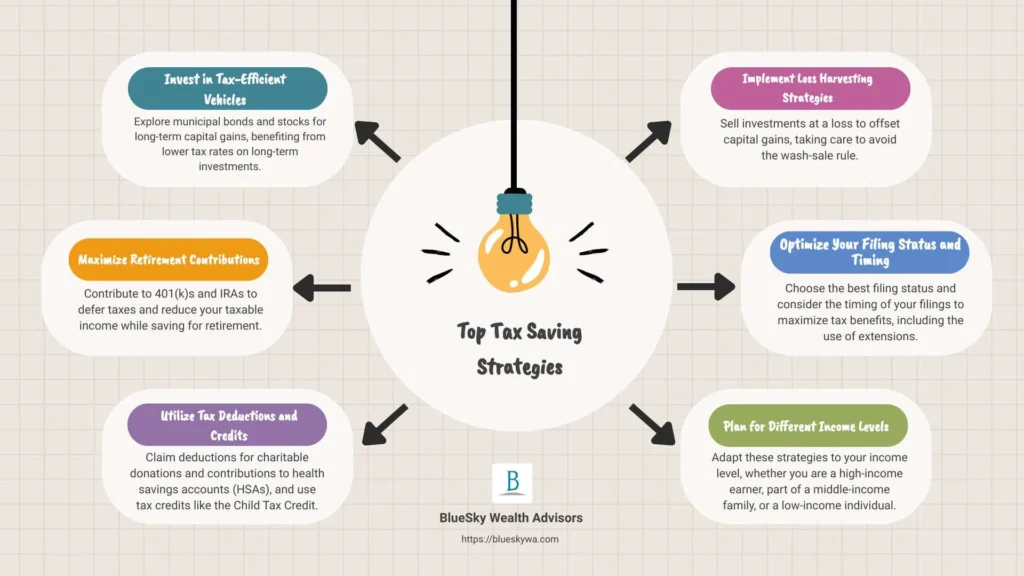

Exploring Tax-Advantaged Accounts

Tax-advantaged accounts can help you save more by reducing your tax burden:

401(k), IRA, and Roth IRA

401(k)s and IRAs allow pre-tax contributions, reducing your taxable income. Roth IRAs use post-tax contributions, but your earnings grow tax-free.

Tax Benefits of These Accounts

These accounts are a smart way to build retirement savings as they grow without the drag of taxes.

Managing Emotions in Investing

The emotional side of investing is often underestimated. Here’s how to keep emotions in check:

Avoiding Panic Selling

Market dips are inevitable. Panic selling can turn temporary losses into permanent ones.

Staying Focused on Long-Term Goals

Remembering why you invested in the first place can help you avoid emotional reactions to market volatility.

Common Mistakes to Avoid as a Beginner Investor

Learning from common pitfalls can save you from costly mistakes:

Timing the Market

Trying to predict market movements is challenging and often backfires. Stick to a consistent strategy instead.

Following Market Hype

Investing based on trends can lead to losses when the hype fades. Make decisions based on research.

Lack of Research and Planning

Investing without a plan is like setting sail without a map. Do your research to understand the assets you’re buying.

The Role of Financial Advisors

A financial advisor can provide valuable guidance, especially for beginners or those with complex financial needs.

When to Consider a Financial Advisor

Consider one if you’re uncertain about your options, have significant assets, or need personalized advice.

How They Can Help Achieve Financial Goals

Advisors can help you create a tailored strategy, balance risk, and provide insights that align with your goals.

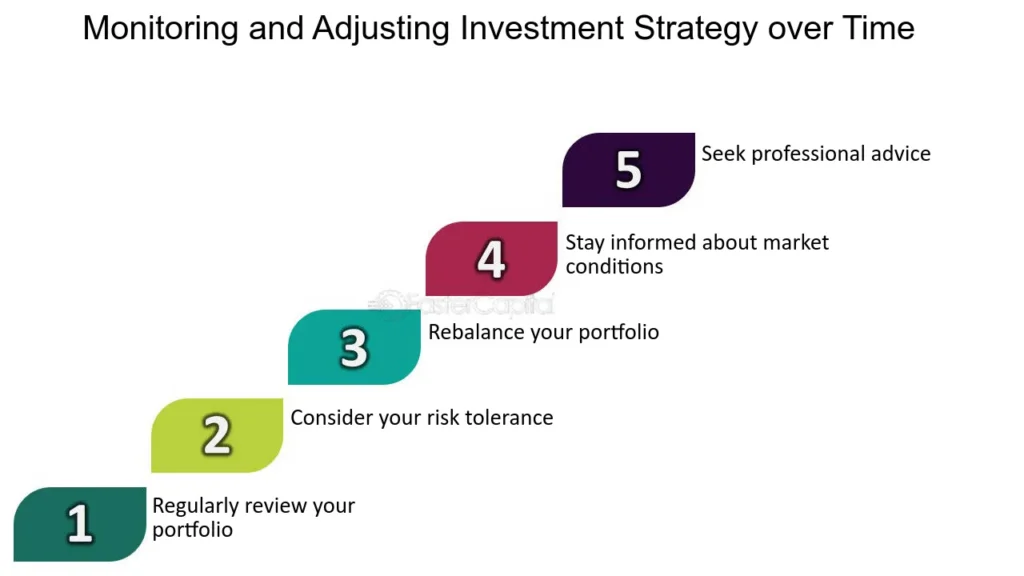

Tracking and Adjusting Your Investment Strategy

Monitoring your investments regularly helps you stay on track:

Reviewing Performance Regularly

Reviewing helps you understand if your investments are meeting expectations. Annual check-ins are generally sufficient.

Making Adjustments Based on Life Changes

Life changes like marriage, a new job, or retirement plans can impact your investment needs, requiring adjustments.

Conclusion and Key Takeaways

Investing is a powerful tool to grow your wealth, but it requires knowledge, patience, and a solid plan. Start with clear goals, diversify, and stay consistent. Over time, you’ll see the magic of compounding and your financial dreams becoming reality.

FAQs about Investing

1. What is the best age to start investing?

It’s never too early or late to start, but the sooner, the better, as it allows you more time to benefit from compound interest.

2. How much money should I invest initially?

There’s no set amount, but many advisors recommend starting with what you can afford comfortably, even if it’s a small amount.

3. What is the difference between stocks and bonds?

Stocks represent ownership in a company and are typically riskier, while bonds are loans to a company or government with lower risk.

4. Do I need a financial advisor?

It depends. If you’re unsure about your strategy or have complex financial needs, an advisor can offer guidance.

5. How often should I review my investments?

Once or twice a year is usually sufficient, unless there’s a major life event or market change that impacts your goals.

You might also like:

10 Proven Money-Making Strategies You Can Start Today!

Unlocking the Winning Mindset: 10 Habits of Highly Successful People

How to Build Unshakable Confidence: 5 Secrets from Experts

Think Like a Millionaire: The Money Mindset You Need for Success