Imagine waking up each day knowing you don’t have to worry about bills, or wishing you had more time for what really matters. That’s the dream behind passive wealth—a lifestyle that frees you from daily financial stress and allows you to live life on your terms. While it requires time and dedication to build, passive wealth can provide the financial freedom that so many people long for. In this article, we’ll explore what passive wealth is, different ways to achieve it, and how you can start making it work for you.

Understanding Passive Wealth

Passive wealth is all about making money work for you. Unlike active income, which comes from trading time for money (like a job or freelance work), passive income is generated from assets or investments that require minimal ongoing effort. This could be from real estate investments, stocks that pay dividends, or online ventures like affiliate marketing. The aim is to set up revenue streams that keep working, even if you take a step back.

Why Passive Wealth Matters for Financial Freedom

Creating passive wealth has profound benefits:

- Financial Stability: You have a consistent cash flow that isn’t dependent on working hours.

- More Free Time: You can focus on family, hobbies, or projects you’re passionate about without the stress of daily financial upkeep.

- Long-Term Security: Passive income streams grow over time, setting you up for a secure financial future and peace of mind.

Building passive wealth may take time, but it’s a worthy investment for the freedom and stability it brings.

Dispelling Myths About Passive Wealth

Passive wealth isn’t a magic money-maker; it takes time and strategy. Here are some common myths:

- “Passive Wealth is Easy Money”: It’s tempting to think passive income is all relaxation and cash flow, but in reality, it requires upfront work. Building a website, buying a rental property, or setting up an online store involves both time and effort.

- “It’s Just Another Get-Rich-Quick Scheme”: Passive income requires patience and a steady approach. Unlike quick schemes, building passive wealth is more like planting a tree—it grows over time with care and consistency.

Popular Passive Income Streams Explained

Here’s a breakdown of some of the most effective ways to generate passive income:

- Real Estate and Property Rentals: Buying property and renting it out can provide steady cash flow. REITs offer a way to invest in real estate without managing property directly.

- Dividend Stocks: Investing in stocks that pay dividends allows you to earn part of a company’s profit regularly.

- Affiliate Marketing: You earn commissions by promoting others’ products online through links or ads.

- E-commerce and Dropshipping: Running an online store without the hassle of inventory by working with dropshipping suppliers.

- Digital Products: Selling downloadable products like e-books, templates, or courses that people buy repeatedly.

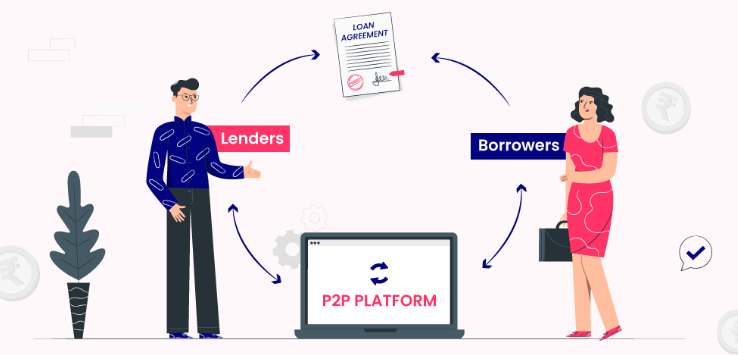

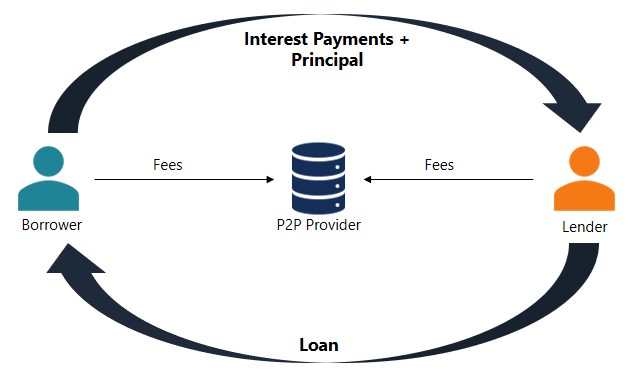

- Peer-to-Peer Lending: Lending money to individuals or small businesses through platforms that let you earn interest.

- Creative Royalties: If you write books, license photos, or create music, royalties can be a steady source of passive income.

Selecting Your Ideal Passive Income Stream

Choosing a passive income stream involves aligning it with your strengths and financial situation. Consider:

- Your Skills and Interests: If you love writing, try digital products; if you’re business-savvy, real estate might be more up your alley.

- Capital Needs: Some streams, like real estate, need a larger upfront investment, while others, like affiliate marketing, require minimal capital.

- Time Commitment: Balance the time you’re willing to invest with your income goals. Some options require regular monitoring, while others are set-and-forget.

Real Estate Investments: A Prime Path to Passive Wealth

Real estate remains one of the most reliable ways to build wealth. Here’s how to get started:

- Types of Investments: Rental properties are popular for those wanting hands-on involvement, while REITs offer a way to earn from real estate without managing properties.

- Benefits and Challenges: Real estate can appreciate in value, generate rental income, and provide tax benefits, but it also comes with risks like maintenance costs and market fluctuations.

- Getting Started: Assess your budget, learn about the market, and possibly partner with experienced investors to minimize risk.

Dividend Stocks as a Reliable Passive Income Source

Stocks that pay dividends can be a fantastic addition to a passive wealth portfolio:

- How Dividends Work: Companies distribute part of their profits to shareholders. The more shares you hold, the more dividends you receive.

- Steps to Invest: Start by researching stable companies with a history of dividend payments, diversify your holdings, and consider reinvesting dividends for compound growth.

- Maximizing Returns: Reinvesting dividends is a powerful strategy that uses the power of compound interest to grow your wealth over time.

Earning with Affiliate Marketing

Affiliate marketing can be a great entry point for generating passive income online:

- How It Works: Promote products on your website, blog, or social media. Every sale through your link earns you a commission.

- Choosing Products and Platforms: Select reputable products relevant to your audience. Platforms like Amazon Affiliates, ShareASale, or ClickBank offer diverse options.

- Consistency Tips: Post consistently, create valuable content, and choose products that genuinely interest you.

Creating and Selling Digital Products for Passive Income

Digital products are fantastic assets because they can be created once and sold many times:

- Types of Products: E-books, courses, templates, and printables are popular and accessible options.

- Selling Platforms: Marketplaces like Etsy, Teachable, and Gumroad allow creators to list and sell products easily.

- Marketing Tips: Use social media and email marketing to drive traffic to your products, and consider creating a blog or YouTube channel to increase visibility.

Profiting from E-commerce and Drop shipping

Starting an online store can be highly rewarding, especially with drop shipping:

- Benefits: No need to handle inventory; you’re the middleman between the customer and supplier.

- Challenges: High competition and lower profit margins require a smart niche choice and strong marketing.

- How to Start: Choose a reliable dropshipping platform like Shopify or WooCommerce, select a profitable niche, and focus on providing value to customers.

Using Peer-to-Peer Lending for Passive Income

Peer-to-peer lending allows you to lend money to others and earn interest:

- Basics: P2P platforms match lenders with borrowers, who then pay back with interest.

- Risk and Reward: Higher returns can come with higher risk. Choose borrowers carefully and diversify your loans.

- Platform Options: Popular choices include LendingClub and Prosper. Research platforms that align with your risk tolerance.

Long-Term Planning for Passive Wealth Growth

Building passive wealth is a marathon, not a sprint. Key strategies:

- Reinvest Income: Use earnings from one stream to grow another, whether it’s reinvesting dividends or profits from digital products.

- Emergency Fund: Having backup funds protects you during market downturns or unexpected events.

- Consistent Monitoring: Check in on investments periodically to ensure they’re performing well and make adjustments as needed.

Managing and Scaling Your Passive Income Sources

Balancing multiple income sources is essential for scaling up without burnout:

- Diversification: Spread your investments across different assets to protect your overall wealth.

- Effective Management: Allocate time each month to review performance and make adjustments.

- Avoiding Burnout: Automate where possible, hire help if needed, and remember to take breaks to keep your journey sustainable.

Conclusion

Passive wealth is achievable for anyone willing to commit to the journey. From real estate to affiliate marketing, there are countless options to explore. Start with what suits your skills and resources best, keep growing and diversifying, and soon enough, you’ll experience the freedom that passive wealth can bring.

FAQs

- What’s the best passive income stream for beginners?

Affiliate marketing and digital products are beginner-friendly due to low startup costs and simple setups. - How much money do I need to start building passive wealth?

This depends on your chosen path. Real estate requires more capital, while digital products and affiliate marketing require minimal funds. - How long does it take to see results?

Most passive income streams take several months to a few years to mature, but patience is key. - Can passive income replace my job?

Yes, with time, multiple income streams can help you transition away from a 9-5 job. - Is passive income taxed differently?

Yes, some passive income types like dividends have different tax rules. Consulting a tax professional is advisable.

You might also like:

Think Like a Millionaire: The Money Mindset You Need for Success

From Broke to Rich: Transform Your Finances in 30 Days

10 Simple Fitness Tips That Will Transform Your Body in 30 Days

10 Must-Have Wardrobe Essentials Every Man Needs in 2024

Master These 5 In-Demand Skills to Dominate 2025